Investment Advisory Services

PMA Asset Management, LLC is focused on serving the investment needs of public entities, insurance companies and other institutional investors. As a registered investment advisor, we have been providing customized portfolio solutions since 2002. With over $28.5 billion in assets under management as of March 31, 2024, we are a valued resource for our institutional clients, which include local government investment pools, insurance companies, schools, cities, counties, non-profit, self-insurance and financial entities.

We believe an investment process, informed by in-depth research and guided by risk management, leads to a diversified solution that can generate value-added investment returns.

Our experienced professionals propose solutions based on a thorough understanding of our clients’ needs and the unique investment challenges each of them face. We partner with our clients to become their trusted advisor, recognizing the safety of principal is paramount in our investment process.

- Investment Experience: Performance is a core value of our firm. Our leadership and senior investment professionals have decades of portfolio management experience through all types of market cycles to help our clients meet their investment goals.

- Public Sector and Insurance Experience: PMA Asset Management focuses its services on public fund and insurance clientele, which helps us understand the investment and financial challenges that our clients face. Many of our investment professionals have valuable experience serving the public sector or as insurance company investment professionals.

- Independent Research: Credit research is foundational to our investment approach and the firm’s history itself. Our research team employs a rigorous fundamental process to evaluate and identify high-quality investments.

- Robust Risk Management and Compliance: Integrity is a core value of our firm. We believe that careful analysis, diligence and risk management are essential to quality client outcomes. Strict compliance with investment policies, state statutes and other governing documents are built into our order management system and independently evaluated by our Compliance team.

- Personalized Client Service: Commitment to our clients is a core value of our firm. Based on our years of experience, we understand the intricacies that are involved with achieving the financial goals of our public fund and insurance clients. Our dedicated sales and service professionals constantly interact with our clients to fully understand their challenges and how we can best support them in their work. We provide leading, interactive portfolio reporting tools that provide our clients full access/integration to their underlying investment/accounting data.

FINANCIAL STRATEGIES FOR PEACE OF MIND.

Customized Investment Solutions

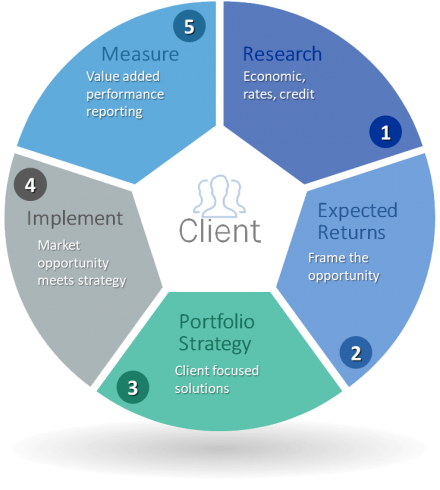

One of the key ways we add value is by thoroughly understanding our client’s unique needs when establishing portfolio strategy. Through client partnerships and ongoing communication, PMA Asset Management builds a holistic understanding of client needs and creates unique customized investment solutions for each client. Regular meetings promote mutual understanding of market developments and evolving client goals. Portfolio strategy will evolve as we actively manage client portfolios. Portfolio strategy, idea generation, investment decisions and formal review occur throughout the investment process.

Investment Process

Investment Philosophy

PMA Asset Management believes an investment process informed by in-depth research and guided by risk management leads to a diversified portfolio solution that can generate value-added investment returns. As experienced fiduciaries focused on managing governmental and insurance portfolios, our philosophy has consistently emphasized the safety of principal, provision of suitable liquidity and the generation of yield – in that order of importance.

Investment Allocation

Done correctly, portfolio investment strategy can help to support, enhance, and achieve client objectives. But most conventional asset allocation approaches focus solely on risk and return at a single point in time.

Our leading-edge OBAA® goes well beyond these conventional approaches to fully align the portfolio to help support your goals.

Our investment team thoroughly understands each client’s goals and constraints to help ensure no opportunities are undertaken without full understanding of the risks, and their effects on the client’s broader goals and objectives.

The Benefits of OBAA®

Goals-Driven: An asset allocation solution based on your strategic goals, not arbitrary risk or return metrics.

Customized: Each OBAA® solution is uniquely designed to help meet your needs. It is not an off-the-shelf solution.

Dynamic: An allocation that evolves with changes in the markets and your business to stay fully aligned with your goals.

Transparent: You will always know the rationale for your portfolio structure and receive ongoing insights into how it contributes to your goals.

Forward-Looking: OBAA® creates a strategic plan for the portfolio well into the future.

Investment Styles & Capabilities

PMA Asset Management, LLC offers a wide range of investment styles and strategies for our clients, recognizing that unique client needs span the maturity and risk spectrums. We assist clients with developing customized investment solutions by understanding your needs and objectives. Investment solutions are implemented across our diversified asset classes and investment strategies.

Our strategies encompass the shortest end of the curve in the cash and ultra-short space, crossing into the intermediate through our fixed income strategies, and longer-term with highly diversified multi-asset and equity strategies. We combine fundamental research with your investment objectives to generate a diversified portfolio solution that is uniquely client focused. Whether you are a government entity maximizing portfolio liquidity, an insurer trying to minimize surplus volatility, or a not-for-profit maintaining your spending policy, we can assist you. Our team’s knowledge and experience affords our clients the flexibility of a full-service investment advisor to meet constantly changing market conditions and achieve dynamic results.

GIPS Compliant

PMA Asset Management, LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has been independently verified for the period of January 1, 2007 through December 31, 2021.

GIPS is a set of standardized, industry-wide ethical principles that guide investment firms on how to calculate and present their investment performance to prospective clients. Although the adoption of GIPS is not mandated by regulation, it is considered best practice for investment advisors. Firms that claim GIPS compliance adhere to all applicable requirements of the GIPS standards, but do so through an ethical commitment to best practices.

As a fiduciary that places a high value on transparency in everything we do, adopting the GIPS standards to use the most rigorous performance calculations and presentation standards in our reporting is directly consistent with PMA’s core values of integrity, commitment and performance. As a growing firm that provides investment advisory services for public clients throughout the United States, we are extremely proud to have undergone the demanding process to claim compliance with the GIPS standards. The firm is defined as PMA Asset Management, LLC, an independent investment advisor registered under the Investment Advisers Act of 1940.

To obtain a compliant presentation and/or the Firm’s list of composite descriptions, please contact Pat Harris, Vice President – Customer Solutions.

About the GIPS standards

The GIPS standards are currently adopted in 41 countries and are recognized around the world for their credibility, integrity, scope, uniformity, and enabling direct comparability of a firm’s track record.

GIPS® is a registered trademark of CFA Institute.

Our Team

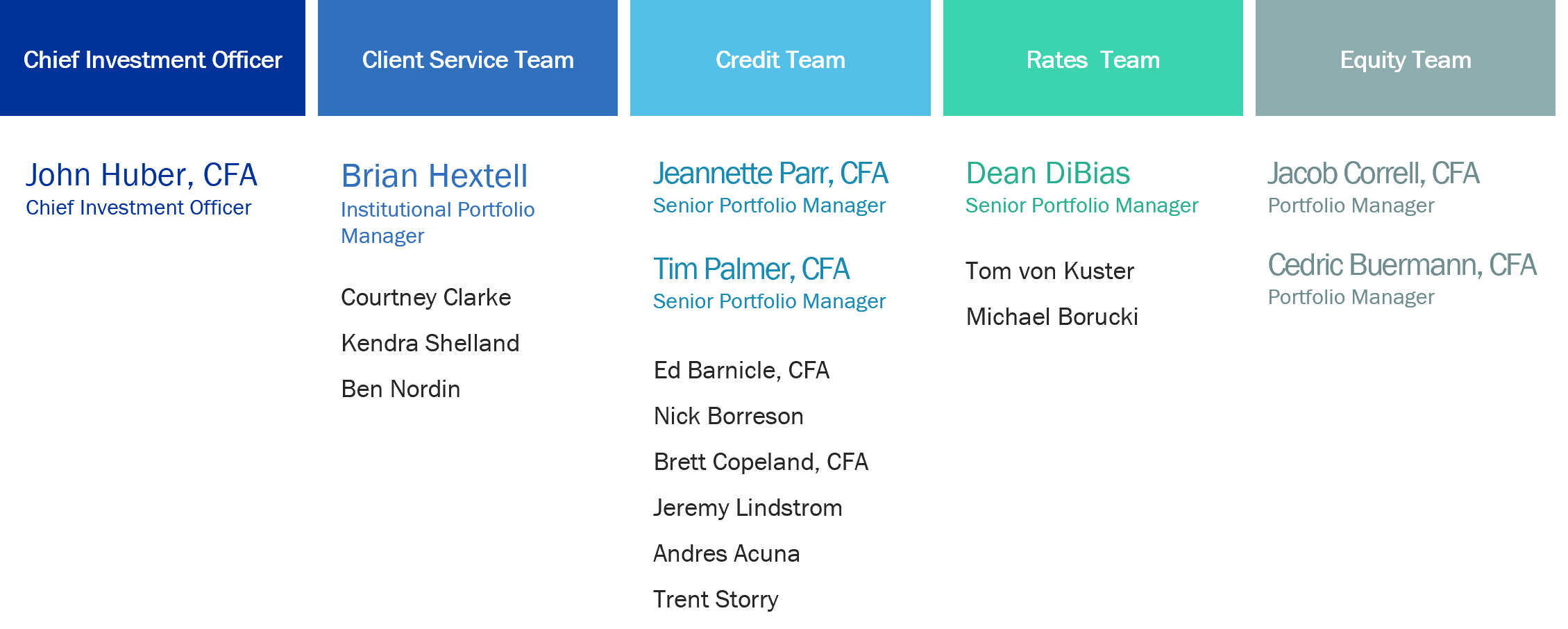

PMA Asset Management Organizational Chart